Primary Business Tradeline

Pay Upfront Before The Tradeline Posts

*Most Popular Choice Pay Upfront Through FDIC Insured, Secured Merchant Account

Tradeline Posting Info:

Entity Must Be Active With The Secretary of State, In Good Standing & 7 Months or Older

All Tradelines Report To...

S.B.F.E. and Experian Business

Tradeline Posting: Within 30 Days of Order

**LIMITED SPOTS AVAILABLE**

How These Tradelines Work

New Lines vs. Backdated Lines

New Lines (Start Now)

Brand-new accounts that start reporting this month so lenders see your business making payments right away.

Backdated Lines (Head Start)

These show 12–24 months of on-time payments from day one — instant age and trust that can help unlock higher approvals.

Tradeline Requirements

Quick overview of what your business needs to qualify:

✅ Business is 7+ months old (for new lines)

✅ Backdated lines require business to be 12+ months old

✅ Registered as an LLC, S-Corp, or C-Corp

✅ Active and in good standing with the Secretary of State

$25K Installment Tradeline

$1,700

Starter business cards & store cards

Work van / small business vehicle

NET accounts + basic limits

Credibility without years in biz

Begin stacking lines

$50K Installment Tradeline

$3,000

$25K–$75K biz cards

Entry-level biz loans

Office gear or small fleet

Higher-tier store/NET30s

Fintech & alt-funding ready

Most Popular

$100K Installment Tradeline

$4,500

$50K–$150K cards & LOCs

No-PG equip. financing & MCAs

SBA microloans / WC lines

Biz vehicle leases / small truck

Multi-card stacks w/ majors

$150K Installment Tradeline

$5,500

$100K+ limits from banks/CUs

Corporate gas / fleet funding

Real estate or build-out ready

Private/venture funding options

Multiple lines / split limits

Option 2: Backdated Installment Tradelines

Upload: 12th • Posting: by 22nd

How Backdated Lines Work: your SBFE file shows the backdated payment history right away. On Experian, the line first shows the full balance, then it auto-corrects on the next monthly billing cycle to reflect the proper backdated status.

$25K Backdated Installment

$2,500

Appears ~12 months old

Faster starter approvals

Store cards & NET accounts

Early credibility signal

Stack more lines sooner

$50K Backdated Installment

$3,500

12–24 months of history

$25K–$75K biz card lanes

Entry loans underwrite easier

Higher-tier vendor accounts

Speeds up trust with lenders

Most Popular

$100K Backdated Installment

$5,500

$50K–$150K cards & LOCs

Seasoned trust from day one

SBA microloans / WC lines

Vehicle leases & equipment

Multi-card stacks w/ majors

$150K Backdated Installment

$6,500

$100K+ limits from banks/CUs

Corporate gas & fleet programs

Real estate build-outs ready

Private/venture funding lanes

Supports multiple split limits

$250K Backdated Installment

$12,000

Positioned for $150K–$300K total approvals

Secured LOCs & high-limit loans

Fleets, inventory, or marketing capital

Bank statement & term loans

Funding-ready for institutional lenders

$500K Backdated Installment

$15,000

Approved for $250K+ through multiple sources

High-limit charge cards & unsecured LOCs

CRE, build-out, or franchise financing

Bank-level underwriting & private capital

Scale with multi-million lender partners

Who Needs Primary Business Tradelines

Who Primary Business Tradelines Are For...

PRIMARY BUSINESS TRADELINES could be for you if...

You're change your current business financing situation

You're ready to take action

You're ready to get approved for HIGH-LIMIT business financing

You're ready to invest in yourself and your business

Primary Business Tradelines Are Not For...

PRIMARY BUSINESS TRADELINES are not for you if...

You're caught in a "learning loop" for more information

You're not looking to add more "depth" to the business credit profile

You're not willing or able to invest into yourself or your business

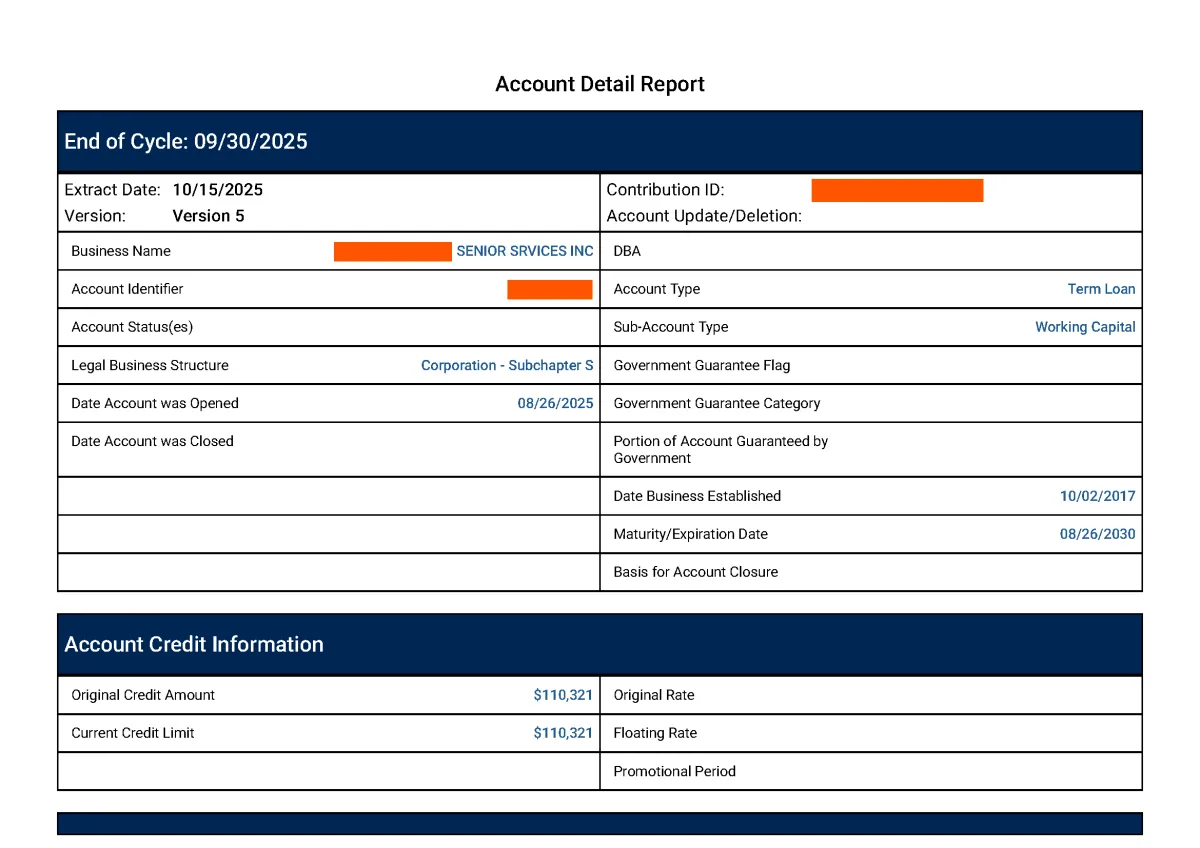

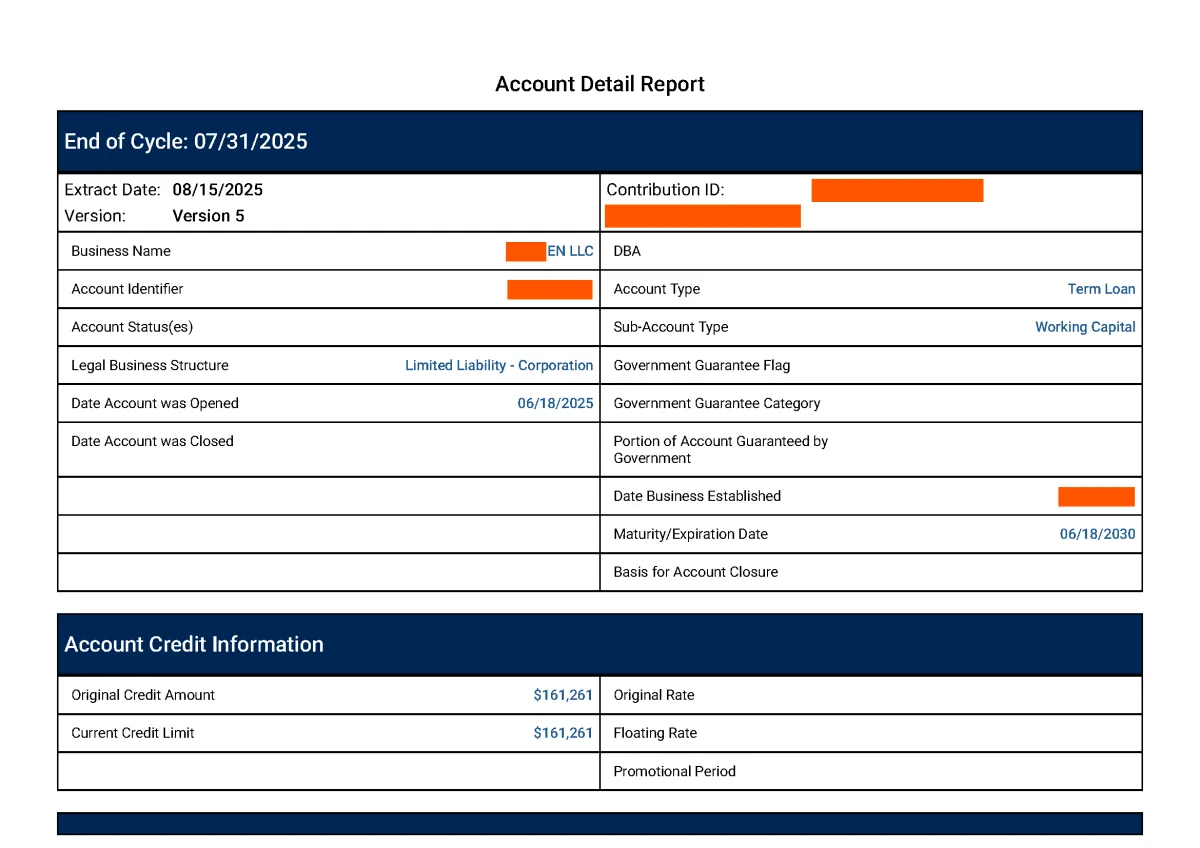

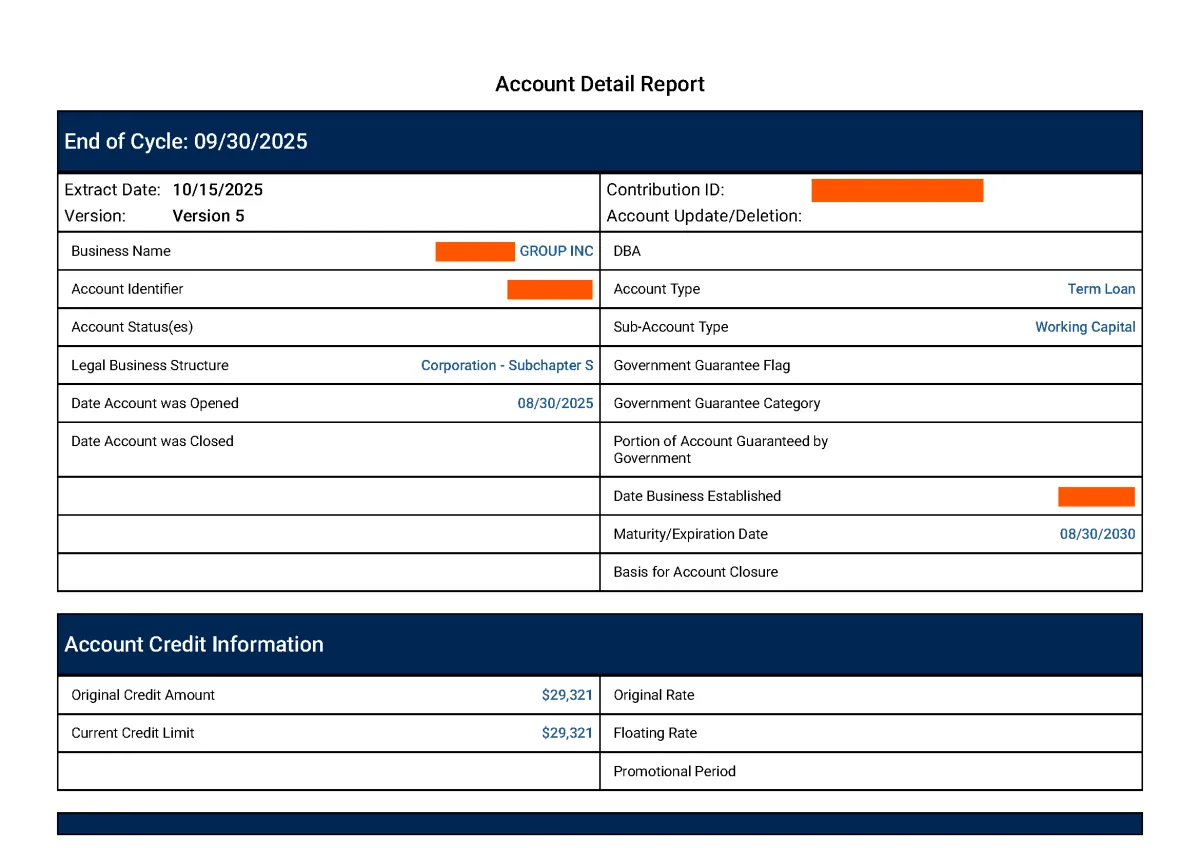

Proof of Posting

Real reports from real clients — posted to Experian Business & SBFE

Reported to Experian Business and the S.B.F.E.

Reported to Experian Business and the S.B.F.E.

Reported to Experian Business and the S.B.F.E.

Reported to Experian Business and the S.B.F.E.

Frequently Asked Question

What Business Credit Bureaus Do the Tradelines Report To?

Our Primary Business Tradelines Report to S.B.F.E. (small business financial exchange) and Experian Business Commercial Credit.

When Does The Tradeline Post?

The Tradeline will post on your business credit profile within 30 days.

How Will I Know My Tradeline Has Posted?

Once your Tradeline has posted, we will provide you with a copy of the S.B.F.E business report. You will also be provided with a link to Experian Business Credit Reports, where you can order an additional business credit report for $49.99

How Will My Primary Business Tradeline Report?

Your Primary Business Tradeline will report as a new, open and active account that reports to your business credit profile permanently.

Will Tradelines guarantee me funding?

We are not able to guarantee funding for you or your company because you have added a Primary Business Tradeline. Our Tradelines are customized to assist you and your business with getting approved for higher limits and better rates... showing credibility to banks and lenders. We always recommend you have one of the 3 "C's" of Cash-flow, Collateral or Credit as well, which will make your journey to obtaining financing much smoother.

Office: 888 Prospect St Suite 200, La Jolla, CA 92037, United States

Call: 844-689-0199

Copyright 2023 | King Credit Services | All Rights Reserved